June 2024 | The Advisor Authority Team

Key Takeaways:

- Work smarter, not harder: The Elite Advisor Program teaches advisors nine effective methods for attracting clients, shortening the prospecting process, and transforming their advisory business.

- By understanding their target market’s needs and tailoring their approach, advisor students saw significant growth in net new assets and client engagement, leading to increased revenue.

- Investing in team training and implementing streamlined processes were key factors in advisors’ ability to grow their teams, increase revenue, and add new offerings like insurance services.

Suppose you’re looking to enhance your skills and transform your advisory business while taking it to the next level. In that case, you may be reviewing training opportunities from various providers—but how do you know which one’s right for you?

The Elite Advisor Program empowers growth-focused advisors who are ready to transform their advisory business and master their mindset with the help of a comprehensive training system. Simply put, this program equips advisors with proven, actionable strategies to achieve their business goals. But what really makes this program stand out—as you’ll see below—is its ability to provide real-world strategies for success.

To help you better understand just how impactful this program is, we’re sharing some of the most eye-opening results from our recent Total Student Performance Survey.

Stat #1: Closing Ratio

75% of surveyed students are closing new clients faster, and they close with 28% fewer meetings needed.

Our students were taught nine highly effective methods for bringing more clients to their firm while spending less time and money than traditional marketing methods. By working smarter, not harder, they were able to market themselves to the right audience, which in turn shortened the entire prospecting process.

These nine marketing and prospecting techniques included:

- Leveraging inbound marketing channels (social media, email marketing, and content marketing)

- Establishing a referral program

- Developing strategic partnerships

- Networking

- Hosting webinars

- Hosting workshops

- Optimizing your website to attract your target audience

- Engaging with your local community

Understanding the psychological factors that drive client decision-making

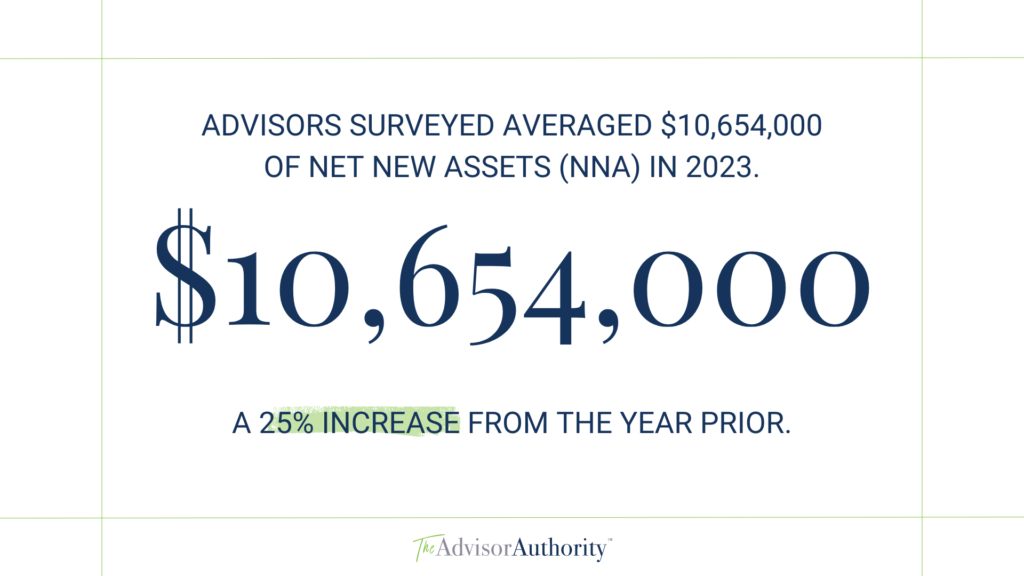

Stat #2: AUM Growth

Students averaged $10,654,000 of net new assets (NNA) in 2023, a 25% increase from the year prior. Plus, 82% of students increased their NNA per client by 84% on average—from $587,000 to $1,081,000 AUM.

One of the most impactful lessons we reiterate over and over again during this program is that advisors must determine who their best target market is, what their needs are, and how they can most effectively address them.

By understanding their unique challenges and aspirations, our students were able to successfully tailor their approach and messaging to resonate with prospects on a deeper level. This targeted approach not only helped them attract more investors who were good fits for their services but also enhanced their ability to address their needs effectively, ultimately leading to more prospects to transition to new clients.

Once students were able to connect with their ideal audiences, they implemented our proven sales scripts from “The Secret Sauce” methods to close the deal.

Stat #3: Staffing

Our students grew their teams by 43%.

Team member training is a big component of our Elite Advisor Program. Why? Because a well-trained team can significantly enhance the implementation of your marketing, sales, and client service best practices.

Because our students invested in their team’s training and development, they were able to more effectively work toward their business goals, establish their firms as leaders in the industry, and set themselves up for long-term success.

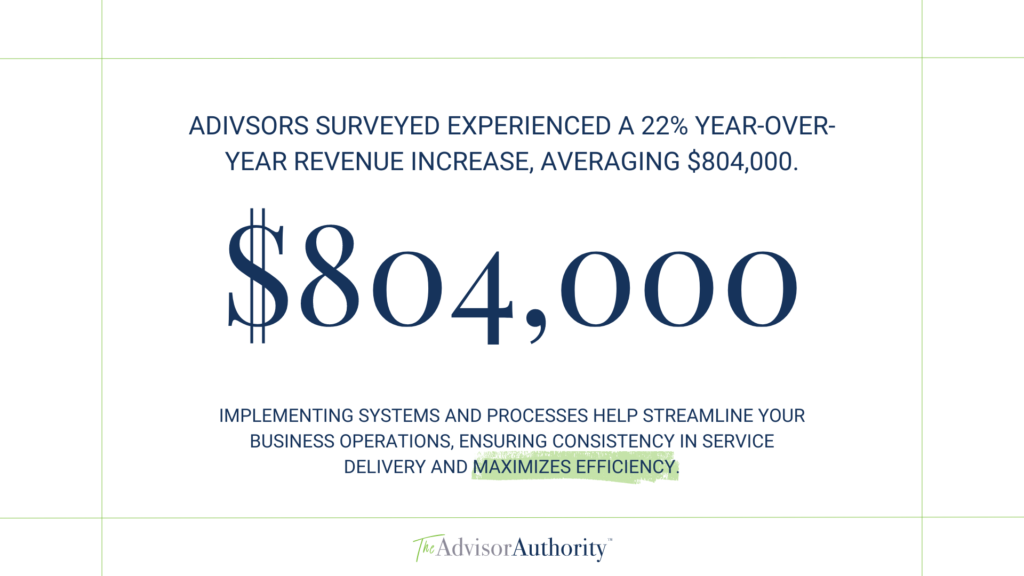

Stat #4: Overall Revenue Growth

Students experienced a 22% year-over-year revenue increase, averaging $804,000.

Another key component of our program is implementing the systems and processes that can help streamline your business operations, which ensures consistency in service delivery and maximizes efficiency.

Our students were taught how to hire the right team members for the right roles in order to drive long-term revenue growth.

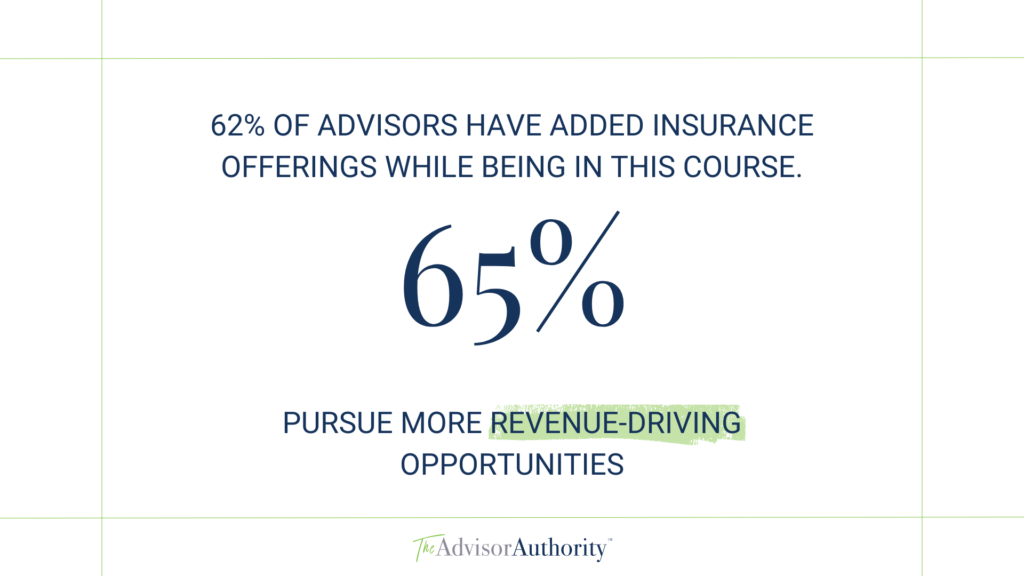

Stat #5: Insurance Revenue Growth

62% of students added insurance offerings while being in this course.

Because our students were able to delegate tasks and processes to well-trained team members, they could pursue more revenue-driving opportunities—such as incorporating insurance into their firm offerings.

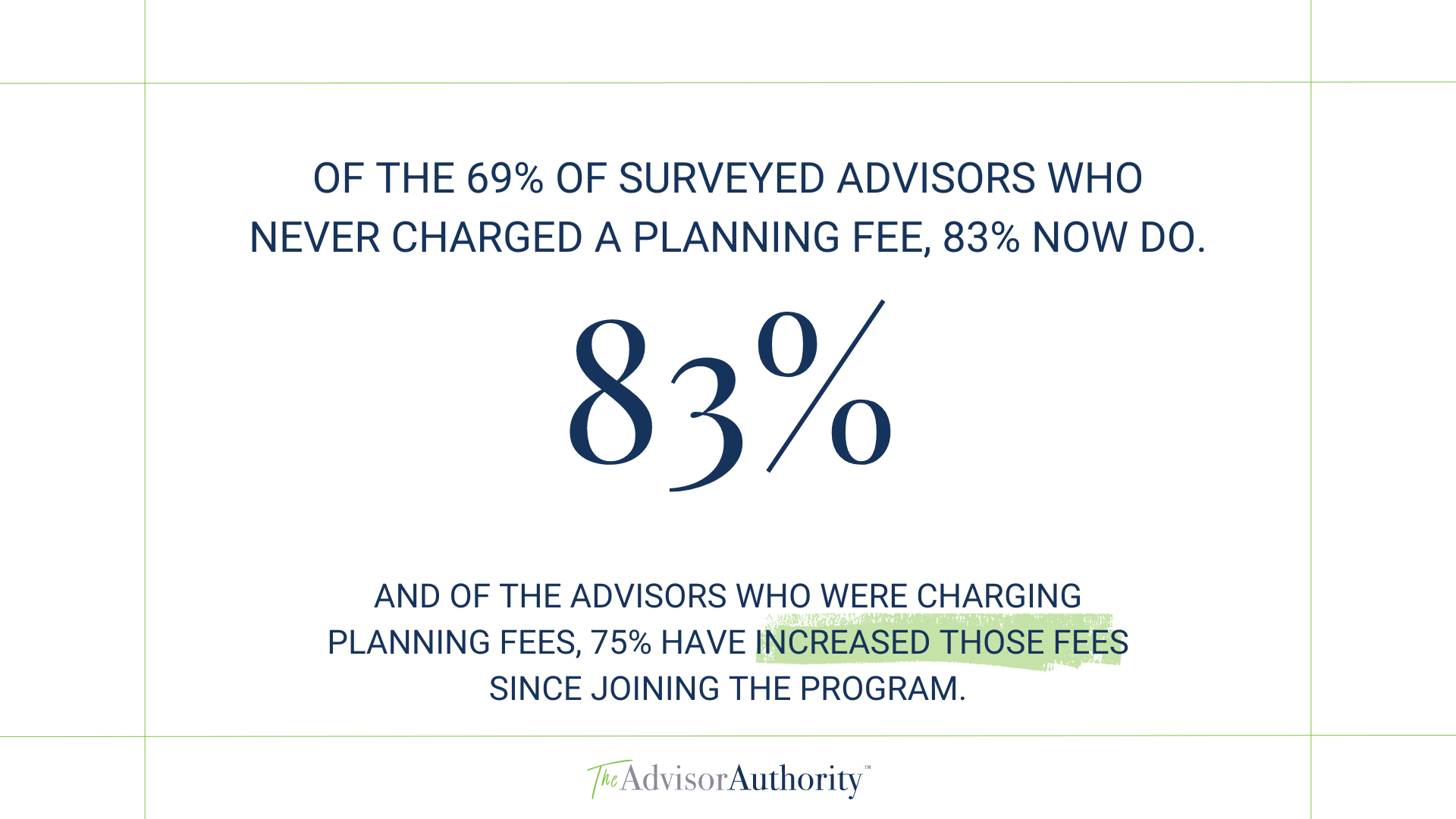

Stat #6: Planning Fee Growth

Of the 69% of students who never charged a planning fee, 83% now do. And of the students who were charging planning fees, 75% have increased those fees since joining the program.

We help our students identify and implement the most effective fee models for their firms. When the majority of our students came to us, they didn’t charge their clients a planning fee. Together, we went over the benefits and potential drawbacks of doing so and gave them everything they needed to move forward with adjusting their fees. As a result, they’ve been able to increase total firm and per-client revenue.

Interested in the Elite Advisor Program?

The Elite Advisor program is designed to equip you with all the essential knowledge and skills you need to succeed as a financial advisor in just six months. Our founder, Erin Botsford, has personally tested and implemented every aspect of this training, ensuring its effectiveness. We don’t waste time on tools or philosophies that won’t help you grow. Instead, we’ve condensed 30 years of experience into a focused six-month training program.

Want to learn more about how the Elite Advisor Program can help you transform your advisory business and take it to the next level? Watch our client success stories now.