September 2025 | The Advisor Authority Team

Key Takeaways:

- You don’t need more prospects. You need more of the right ones.

- Ideal clients fuel your energy and your growth.

- Clarity on who you serve best transforms your marketing, your team, and your time.

If You Don’t Know Who You’re Looking For, You’ll Find Everyone Else

At LPL Focus this year, I asked a simple question:

“How many of you have your ideal client profile written down?”

Out of a full room of advisors, only a few hands went up.

Now, that’s not shocking. Most advisors think they know who they’re targeting—until you ask them to put it on paper. That’s when the fuzziness shows up.

Without that clarity, it’s easy to fall into the trap of saying yes to anyone who has assets, seems nice, or was referred by a good client. And just like that, you wake up with a full calendar… but a draining, chaotic practice.

If you want to move upmarket and build a business that grows with intention, you need to define exactly who you’re here to serve.

Most Advisors Default to Demographics. That’s Not Enough.

If your current “ideal client” description sounds like this:

- “Pre-retirees with $500K or more”

- “People who value advice”

- “Delegators who want a relationship”

You’re still guessing. And your team can’t build a business around a guess.

High-performing firms don’t just define their ideal client by age or assets. They get specific about:

- Mindset: Are they coachable? Decisive? Fear-driven?

- Behavior: Do they show up prepared? Do they implement?

- Values: Do they prioritize family? Legacy? Lifestyle? Privacy?

- Communication: Do they want deep conversations—or just bullet points?

It’s not enough to know their age, zip code or job title. You need to understand how they think and how they behave when stressed, uncertain, or facing trade-offs.

Because that’s when the real work begins.

Why This Matters More Than You Think

Let’s connect this to your business model:

- Do you have reactive weeks filled with back-to-back meetings?

- Is your team burned out managing high-maintenance clients?

- Are you struggling to scale—even though revenue looks good on paper?

Misaligned clients are often the root cause.

Wrong-fit clients create:

- Scope creep

- Pricing pressure

- Staff turnover

- Bottlenecks in service delivery

- Missed referrals (because they don’t know how to talk about your value)

Right-fit clients do the opposite. They generate momentum and margins. They say thank you. They make work feel like flow.

Here’s How to Get Clear

Start with your top three favorite clients. Ask yourself:

- What transition brought them to you? (Business sale, retirement, inheritance, divorce?)

- What did they want that others overlooked?

- How did they behave in meetings?

- What made them easy to serve—and what would make 10 more of them a dream?

Then ask your team:

- “What client types do you love working with?”

- “Who brings out our best?”

- “Who feels like a drain… even if they pay well?”

This isn’t a solo exercise. Your team has insight you don’t. Your service team knows who respects your time and who constantly pushes the boundaries.

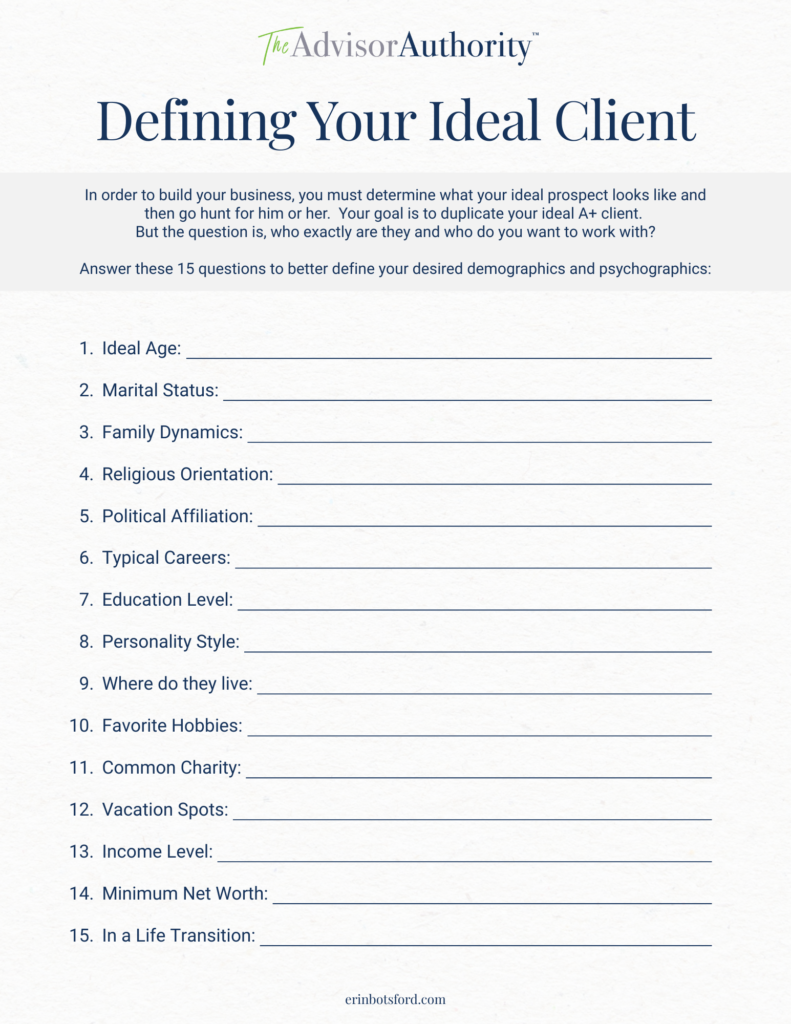

Want a deeper dive? I’ve created a 15-question Ideal Client Profile Worksheet that will walk you through both the numbers and the nuance.

👉 Download the Ideal Client Profile Worksheet

When you do this well, it stops being a guessing game. You start to see patterns. You start recognizing these people in your pipeline.

And best of all, you start saying no to those who aren’t a fit. Not out of arrogance, but alignment.

You Can’t Build a Business on Maybes

One of the biggest mistakes I see advisors make?

They let “maybe” clients clog up their capacity.

- “Maybe they’ll move that account over.”

- “Maybe they’ll refer me.”

- “Maybe they’ll commit after this next review.”

Here’s what I’ve learned: maybes are time thieves. They rob you of focus, clarity, and energy.

When you tolerate the wrong clients, or the not-quite-right ones, you’re spending time, energy, and capacity on people who will never move the needle.

And that crowding? It leaves no room for the clients who actually belong in your business.

Start with One Ideal Persona

You don’t need five client profiles. Start with one.

Pick the person you love working with. The one who lights you up. The one you wish you had ten more of.

The client who:

- Lit you up in meetings

- Paid your fee with zero pushback

- Took action and appreciated your process

- Referred great people without being asked

Then reverse-engineer everything around them:

- Where do they spend time?

- Who do they trust?

- What events trigger their need for advice?

- What objections stop them from hiring someone like you?

Your website, content, team structure, onboarding experience—it should all speak to this person.

Because when you build for them, you naturally repel everyone else. And you should.

The Right Clients Make You Better

You didn’t build your business to stay stuck on the hamster wheel.

You built it for freedom. For fulfillment. For legacy.

Ideal clients are the ones who make that vision possible. They respect your expertise. They trust your team. They implement your advice. They make your firm better, not just bigger.

If you haven’t documented your ideal client in detail, now’s the time.

Download the worksheet. Block 20 minutes on your calendar. Bring your team into the conversation.

You’ll be surprised what clicks into place once you do.